INSIGHT WEEKLY : April 21, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

An easy to read summary to be well informed of topical issues in economics, finance, technology and AI, and cryptos.

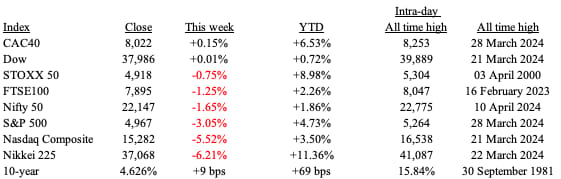

🌐 Major indexes and major stocks

Markets mostly down this week, mainly due to the prospect of interest rates being higher for longer. The expectations of rate cuts had been baked into stock prices but now the prospects appear to be diminishing each week. The revised assumptions are pushing the markets down.

As expected and mentioned in last week’s newsletter, the increase in geopolitical tensions sent the markets down during the week.

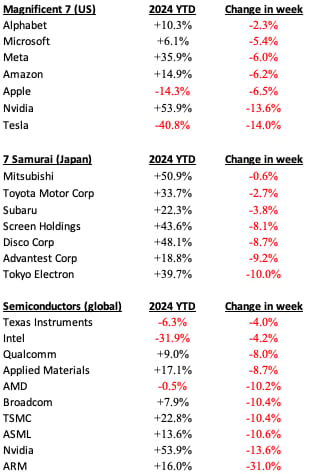

What about the AI boom ? As shown below, the semi conductor stocks are all down this week. If these are the leading indicators of the AI effect, then there has been a rethink of how beneficial AI will be to earnings and therefore stock prices.

No records set this week after many weeks of records.

Japan’s Nikkei 225 showed the biggest decrease during the week. As the index is 9.8% below its all time high in March 2024, it almost at the level to meet the definition of a market correction.

Major stocks of interest :

Semiconductor and tech stocks were affected. ASML, the supplier of chip making machinery had a revenue miss.

Tesla continues to decline, and is now down 40% this year.

What do smart investors do when markets fall ? Here is a quote from the late Charlie Munger :

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

🇬🇧 UK

Inflation was 3.2% in March, down from 3.4% in February. The decline was less than expected by the Bank of England (BOE) forecast. Fuel and communication prices were higher. Governor Bailey of the BOE said that he is still expecting further falls, despite higher services inflation at 6%.

Job market is showing a slowdown, with the unemployment rate hitting a six-month high of 4.2% in February, an increase from 3.9%. This uptick in unemployment, alongside a decrease in job participation and a rise in economic inactivity, is adding to the pressure of an interest rate cut by the Bank of England in the summer.

Wage growth has dipped slightly even though real wages have seen their highest rise since late 2021, fuelled by inflation adjustments and recent tax cuts. But some taxpayers are drifting into higher tax brackets due to frozen income tax thresholds.

FTSE100 is more than -1% this week, and over +2% this year.

🇺🇸 US

Stock prices declined for the third successive week, due to concerns about any escalation in the conflict in the Middle East, and also a growing understanding that interest rates are not going down anytime soon.

Interest rates Chair Powell stated this week that “recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence.”

Bond yields have increased further this week due to the expected lags in interest rate reductions.

S&P500 at 4,918 is -3% in the week and up nearly 5% so far this year.

🇯🇵 Japan

Stock prices declined more than any other major market in the week. In addition to the global factors of Middle East tensions, there was also concern about AI related demand and earnings.

Yen weakened further this week (-0.9%) against the US dollar at 154 and above the 152 level for expected government intervention. The Yen v USD is -8.6% since the start of the year.

Nikkei 225 is more than - 6% this week, and more than +11% this year. Having broken the 1989 record of 38,957 a few weeks, it has now dropped below that level.

The all time high was on March 22 this year at 41,087, and the market closed at 37,068. At 9.8% off its all time high, a further decrease to 10% or more will be defined as a “market correction”.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Chip manufacturing in the US will increase as the U.S. government has committed $6.4 billion to Samsung for constructing state-of-the-art chip manufacturing sites in Austin, Texas in the continuing effort to secure its technological edge. This funding is part of a larger $40 billion investment by Samsung, which includes enhancing an existing factory and building a new one, plus a new research center. This follows a recent $6.6 billion boost to TSMC, signaling a robust effort under the 2022 CHIPS Act to restore American leadership in global semiconductor production.

Nvidia revenue by product has changed due to emphasis on AI. Nividia’s GPU’s are highly sought after and have grown to be 78% of the company’s revenue (see chart below).

Meta v ChatGPT is a new contest. Meta has just released Llama 3, its latest open source language model, and is said to outperform rivals like GPT-3.5.

Llama 3 features versions with 8 billion and 70 billion parameters, with plans to introduce a massive 400 billion+ parameter model. This breakthrough was achieved after two years of developing high-quality training data, refining model architecture, and enhancing instruction fine-tuning techniques. The 70 billion parameter model excels in human evaluations across diverse applications such as coding, reasoning and creative writing.

Google restructures Finance team including layoffs and relocations, focusing on prioritizing investments in artificial intelligence. This shift aligns with broader company efforts to leverage opportunities in AI. The restructuring will impact finance teams globally, with the creation of centralized "hubs" in cities like Bangalore, Mexico City, Dublin, Chicago, and Atlanta, aiming for operational efficiency and around-the-clock service. Despite these changes, Google plans to maintain a strong presence in the San Francisco Bay Area.

Iphone and ChatGPT creators are looking to build a new device.

Jony Ive, former Apple design lead, and Sam Altman, head of OpenAI, are reportedly seeking funding for a new company to develop a personal AI device. This innovative device aims to redefine personal technology by merging aspects of the iPhone and AI technologies like ChatGPT. While details about its design and function are still under wraps, it’s clear that it won’t resemble traditional smartphones. The project aligns with broader industry trends towards integrating AI into hardware, offering more intuitive interactions without screens or conventional user inputs.

🌐 Crypto Corner

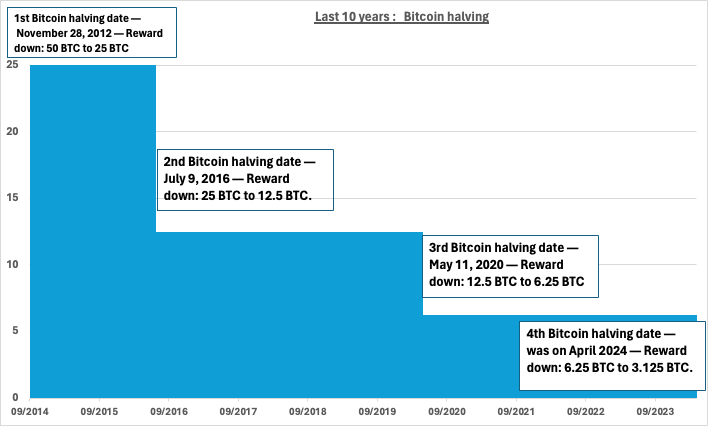

Bitcoin halving completed on Friday. This was the fourth halving which reduced the rewards paid to miners from 6.25 bitcoins to 3.125 bitcoins. Bitcoin’s price fell before the event. The charts below show the pricing in USD over the last 10 years, the halving dates, and also the price leading up to the halving.

The next halving will be in about 4 years after the next 210,000 blocks have been mined.

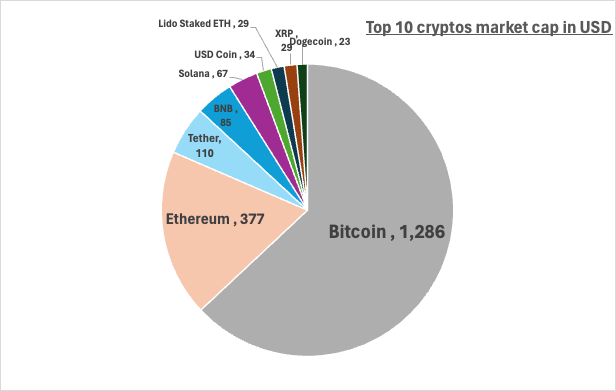

Major cryptos by market value (in USD bn)

Previous newsletter spotlight on Bitcoin halving.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Bernard Arnault and family (LVMH) $214bn ⬆️ $5bn

Jeff Bezos (Amazon) $193bn ⬇️ $10bn

Elon Musk (Tesla, SpaceX) $179bn ⬇️ $13bn (Tesla down 14% in the week)

Mark Zuckerberg (Facebook/Meta) $168bn ⬇️ $11bn

Larry Ellison (Oracle) $142bn ⬇️ $8bn

and watching

21 (down 2 places) Jensen Huang (Nvidia) $77bn ⬇️ $10bn

Potential entrant to the top 5.

SPOTLIGHTS

Earlier :

Japan ;

AI chips ;

Next week : National debt

Coming soon : Future growth sectors, Gold and more !

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.