INSIGHT WEEKLY : March 17, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

Dear Readers

Welcome to the many Citi and BNP Paribas alumni who have joined the readership during the last two weeks. You are in the right place ! This weekly newsletter is designed for a discerning audience seeking to stay informed on topical issues in Economics, Finance, Technology, Artificial Intelligence, and Cryptos. The concise format allows the absorption of key insights in as little as five minutes.

Enjoy this week’s edition ! If you know anyone who might be interested in joining the readership, please share this link

🌐 Major indexes

Two records set this week :

After many weeks of record highs, there are just two all time highs this week. Some markets declined this week after many weeks of gains. Is this a sign of the markets levelling off for some time ? Interest rate cuts are not going to be soon, and the markets have had a good run of AI and tech optimism. Stock prices have already accommodated interest rate cuts to be done in 2024. These cuts may be delayed due to sticky inflation.

Is this the top ?

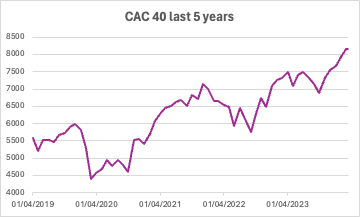

France’s CAC 40 notched up another record this week from previous momentum of expectations of good inflation news, lower interest rates as well as good corporate earnings.

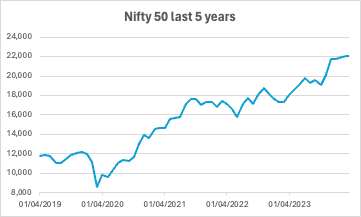

India’s Nifty 50 also continues its run of record breaking weeks due to continued confidence in the Indian economy and strong growth, though there was a pull back in the latter part of the week.

A new deal was signed with European Free Trade Association (EFTA) for $100bn of investment in India across a number of industries. The EFTA members are Norway, Switzerland, Liechtenstein and Iceland.

See earlier spotlight on India - an emerging economic power

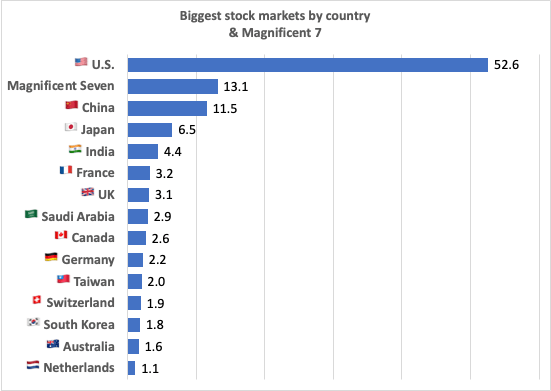

Stock markets by value (in $ trillions)

US markets are the biggest by far, and with a large tech component.

MSCI Global Index is weighted nearly 71% in the US and many global funds benchmark to this index. As this index is so widely referenced, investors buying into global funds find that their investments are skewed heavily to the US because of this weighting.

Magnificent 7 (Microsoft, Apple, Nvidia, Meta, Amazon, Alphabet, Tesla) are 25% of the total US market. If they were a country they would be the second biggest.

🇬🇧 UK

Growth in January was 0.2% following two quarters of negative growth. The UK looks like it is in recovery helped by increased consumer spending, lower inflation and pay growth. This quarter is unlikely to show negative growth so technically the UK will no longer be in recession. The economy is expected to be in low growth for the rest of the year. The Bank of England considers the UK to be in disinflation, near “full employment” and that concerns about potential wage inflation had diminished. The recession may have been shallow but growth is likely to be in the fractions of a percentage point. In other words, the economy is flat lining.

Inflation is down from 10% a year ago to around 4%.

Interest rate cuts may start from the mid year point depending on inflation and other economic data.

FTSE100 is +0.1% since the start of the year.

🇺🇸 US

Producer Price Index (PPI) numbers on Thursday showed an increase of 0.6% in February which was above consensus estimates. It is an early predictor of inflation, so the Consumer Price Index (CPI) may be affected downstream.

Retail sales have been weaker than expected.

Inflation is expected to continue to be sticky. Higher PPI and lower retail sales are moving in opposite directions. Consumer sentiment is down slightly.

Interest rates are not expected to move down soon. The benchmark 10 year Treasury note yield moved up during the week to reflect that. Investors in higher yields took the opportunity to add to their positions.

S&P500 at 5,117 was down slightly during the week. It is up 7.9% so far this year.

🇯🇵 Japan

Nikkei 225 was down 2.47% in the week. It is up over 16% so far this year. There was a great run in the first weeks of the year as Japan attracted the interest of global investors who saw a weaker yen which made stock prices attractive, and also were interested by the reforms under way.

The 34 year record was broken recently indicating that investment in Japan’s stock markets could return.

There has been a pull back in the last two weeks of around 3%, but it is still up over 16% so far this year.

Interest rates in Japan are negative, and the Bank of Japan is taking steps to apply some monetary tightening to curb (low) inflation. An interest rate increase in expected in March or April. The BOJ is seeing weakness in the economy and may hike interest rates by small amounts and infrequently so as not to jeopardise the recovery.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

AI Chips - see last week’s spotlight

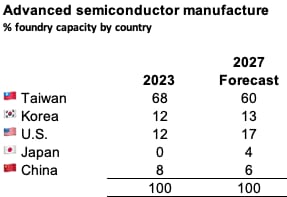

Advanced chip manufacture by country driving the AI revolution. There is an expected shift by 2027 to US and Japan from Taiwan. The CHIPS Act in the US is intended for more chips to be manufactured domestically in the future. Taiwan will still be the world’s top foundry for advanced chips.

Software engineering using AI may become a reality. A Peter Thiel backed startup has produced an AI software engineer called Devin who can complete an entire coding project from start to finish. This is their link : https://www.cognition-labs.com/introducing-devin

Productivity gains from AI could be $1.2 trillion to $2.4 trillion in the global economy over the next decade according to an EY report. Productivity growth across all economies slowed down over the last decade, so AI will be transformative. Another study by Axios/YouGov shows that there is more reticence to use AI tools in Western countries for workplace productivity. India and Indonesia are at the top for early adoption and Europe/US is much lower.

🌐 Crypto Corner

Bitcoin has had a stellar run following the earlier introduction of ETF’s which makes it possible to buy bitcoin through funds. There has been a net inflow of over $9 billion into Bitcoin ETF’s since the SEC approval in January. This widening has brought in retail investors, hedge funds and financial advisors. Bitcoin performance over the last 10 years has been impressive with losses in just 3 years and an average return of 671% per year in the years 2013 to 2023.

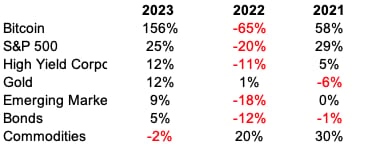

Bitcoin performance v other asset classes :

Bitcoin halving coming up in April ! More on this in upcoming newsletters.

Ethereum the second biggest blockchain after Bitcoin, has had an upgrade. This upgrade called Dencun is intended to improve efficiency and reduce transaction fees on the Layer 2 network. The Layer 2 network are small blockchains than run alongside the main blockchain in order to speed up transactions by reducing the load on the main blockchain.

The ETH price has dropped 10% in the week but is up over 40% this year.

🏅5️⃣ Billionaire Leaderboard

Change in week :

Bernard Arnault and family (LVMH) $236bn ⬆️ $3bn

Jeff Bezos (Amazon) $192bn ⬇️ $2bn (overtakes Elon Musk)

Elon Musk (Tesla, SpaceX) $188bn ⬇️ $7bn (drops to third place as Tesla is down 34% so far this year)

Mark Zuckerberg (Facebook/Meta) $169bn ⬇️ $2bn

Larry Ellison (Oracle) $154bn ⬆️ $15bn (Oracle is up over 12% in the week due to strong earnings from cloud)

and watching

Jensen Huang (Nvidia) $77bn (flat this week). Potential entrant to the top 5 depending on the earnings from Nvidia’s GPU’s.

SPOTLIGHTS

Earlier :

Japan ;

Last week : AI chips

Coming soon : More on AI, Cryptos, National debt, future growth sectors, Gold and more !

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.