INSIGHT WEEKLY : December 31, 2023

An easy to read economic and financial summary. If the images do not load, download external images in your email to see the newsletter in full, or click the link above to read online.

As the year progressed, investors have had a change of heart. No more fears of rate hikes. Anticipation of rate cuts in 2024 became the sentiment in the latter half of the year. A global economic recovery is not yet in sight, but there has been some growth. There is still a risk of recession in 2024, but it is hoped that the central banks will cut rates to stave off this risk. Most indicators are showing signs of a stronger 2024.

The United States continues to stand out as a prime destination for global investors, consistently outshining other markets in performance. This trend shows no indication of waning.

Investors hoping to invest globally by putting their money into global funds find that these funds are US focussed and also skewed to tech. This weighting has helped to provide very good returns.

The global index (MCSI All Country World Index) provides a striking comparison. It is 17% weighted in the Magnificent 7 (Apple, Amazon, Alphabet, Meta Platforms, Microsoft, Nvidia, and Tesla). It is also weighted 17% for Canada, France, China, UK and Japan. 7 companies have the same weighting as 5 countries !

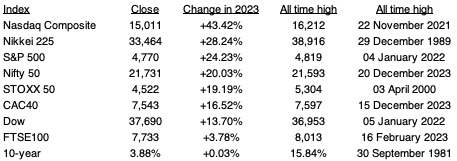

🌐 Major indexes

🇺🇸 US

US Market's Stellar Run: Nasdaq, Dow, and S&P 500 are now on a nine consecutive week run of good performance. There is a lot more optimism in the air. It is expected that this is just not a Santa Claus rally but a longer trend. The tech heavy Nasdaq has been the best performer in 2023 with a whopping 43% increase. The S&P 500, seen as a bellwether of the US market, appreciated by 24%.

📉 Rate Cut Hopes: In the early part of the year, there were fears of inflation, low growth, and increased unemployment. The consensus forecasts were indicating a recession. However actual economic data has been beating forecasts consistently. The remedies for fighting inflation by hiking rates appear to have worked well. As a result a soft landing in 2024 looks very likely, and the market reacted by moving up strongly led by tech stocks.

📈 Bond prices move in the opposite direction to interest rates. As rates are expected to decrease, bond prices (S&P 500 Bond Index) have risen in anticipation by 8% in Quarter 4, and 4% in the month of December. Investors who switched to bonds in the last few months will be happy with the decision that they had made. Further increases are expected as rates start to fall. Investors hoping to get into the bond market, either buy individual bonds or invest in funds which has many different types of bonds.

💥 US Market's Magnificent 7 outperformance in 2023 :

Apple +48%

Amazon + 80%

Alphabet +58%

Meta Platforms +194%

Microsoft +56%

Nvidia +238%

Tesla +101%

🇬🇧 UK

UK's FTSE 100 has risen by only 2.37% in 2023. Investors have preferred other markets due to political uncertainties, Brexit, older, unfashionable companies and not much tech in the UK. Pension funds used to own about 50% of UK stocks in the 1990’s. Now it is just 4% !

🇯🇵 Japan

Nikkei 225 has rallied due to structural reforms in Japan to return cash to shareholders and the steps being taken to address deflation. This has attracted funds from outside Japan willing to pay higher prices for stock. Although the index is up 28% in 2023, it is still below its all time high achieved in 1989 during the bubble.

🇪🇺EU

The STOXX 50 gained nearly 19% in the year. This is also a reflection of hopes of softer monetary policy (lower rates). So a similar pattern to elsewhere.

🚢 Shipping update

Although there is an ongoing risk, Maersk and some others have resumed going through the Red Sea albeit with an increased military presence in the area. The situation is fast changing and container prices are increasing. For example, a container from China to the UK has increased from $1,452 to $1,625, and that’s before other charges are added for the increased risk. About 20% of the world’s container fleet is on a new route.

Bloomberg is reporting that the US is trying to persuade shippers to continue to use the Red Sea / Suez Canal though shippers are waiting to see what a safe passage through these waters will look like.

🛢️ Oil still steady : Despite Red Sea tensions, oil markets continue to remain calm for now (Brent at $77, WTI at $71 per barrel).

💰 Gold's rising : Gold at $2,067 per ounce continue to increase, as Red Sea tensions continue.

🌐 Crypto Corner

Crypto's rebound in 2023:

Cryptos have surged in 2023 by around $800bn. This is after a poor performance in 2022, losing half its value. Solana increased by 1,000% in 2023 ! This is a highly volatile market. Regulators in many countries are tightening up the rules on how digital coins and tokens are marketed/sold to consumers.

🏅5️⃣ Billionaire Leaderboard

Elon Musk (Tesla, SpaceX) $251bn

Bernard Arnault and family (LVMH) $201bn

Jeff Bezos (Amazon) $174bn

Larry Ellison (Oracle) $135bn

Mark Zuckerberg (Facebook/Meta) $125bn

Next week : 2024 outlook

Stay tuned for more insights and updates in a 5 minute round up each week.

If you liked this newsletter, please send this link to friends, family and colleagues https://insight-weekly.beehiiv.com/subscribe