INSIGHT WEEKLY : January 7, 2024

An easy to read economic and financial summary. If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

🌐 Global Outlook

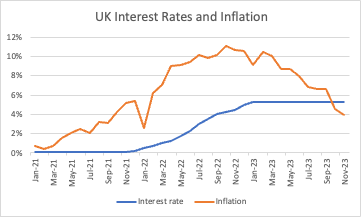

💸 Inflation is expected to fall in 2024. It is a downward trend globally but this trend will vary by country. US inflation is expected to fall sharply. UK inflation is likely to be more persistent. Overall, a soft landing is on the cards. The consensus view is that the war on inflation has been won.

But not everywhere in the G20. Türkiye’s inflation is 65%, and Argentina’s is a staggering 161% !

🧗Growth is expected to slow in early 2024 and pick up later in the year. Investors are eyeing opportunities in a recovering global economy. Elections in the US, UK and other countries, legislative gridlock in the US Congress as well the risks of conflict escalation in Europe and the Middle East keep investors on the sidelines waiting to time their entry into the market. Interest rate reductions will be good for growth and therefore for investment performance in both stocks and bonds.

📉Interest rates Central banks are expected to cut interest rates in response to falling inflation. The inflation target is 2% in many countries with each central bank defining their own preferred measure of what inflation is. The US Federal Reserve could cut as early as May, or even sooner. Some lenders in the UK have cut rates in the mortgage market in the last few days as their borrowing rates in the market have fallen, and that’s before any cut has been announced by the Bank of England.

🔍Investment outlook The US is a big component of global funds and this trend is likely to continue throughout 2024. Global funds are heavily weighted in US and in tech. Investors continue to be interested in technology generally, and in AI specifically. The interest also extends to non tech companies that will be using AI effectively. AI could be the defining characteristic in 2024 and 2025.

7️⃣ Magnificent 7 As this group of stocks are 17% of the MCSI All Country World Index, the performance of these companies is watched by many. Some analysts are suggesting that the composition should change (less tech) with Berkshire Hathaway replacing Meta and Exxon Mobil replacing Tesla. Apple is also less favoured now. Nvidia and Microsoft will be powering AI’s growth, so these two are prime members of the M7. Below are the M7 and how they did in 2023.

Apple +48%

Amazon + 80%

Alphabet +58%

Meta Platforms +194% (will it be replaced by Berkshire Hathaway which was +16% in 2023 ?)

Microsoft +56%

Nvidia +238%

Tesla +101% (will it be replaced by Exxon Mobil which was -9% in 2023 ?)

🌐 Major indexes

🇺🇸 US

Outlook for the US looks promising. It has proved to be a resilient economy, which has seen off high inflation and high interest rates, concerns about wars overseas, and also the pandemic in earlier years.

📉 Rate Cut Hopes:

Inflation is down, and interest rates are expected to be cut around May 2024 or earlier. There could be three or more cuts during the year.

📈S&P 500 forecast

Many analysts are expecting the bellwether S&P 500 to be at 5,000 or higher at the end of 2024. It closed at 4,697 on January 5th. So modest gains compared to 2023 but still expected to exceed its all time high of 4,819. Tech stocks had a good run in 2023, which may not be repeated in 2024, but AI is a significant growth area. Companies outside of technology look like good value, and these could have a good year if some of the shine comes off the tech stocks, and investors switch over to these stocks.

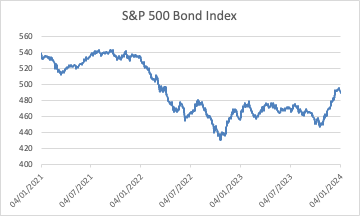

📈Bonds

Bond prices are expected to go up in 2024 as interest rates go down. Prices increased by 8% in the last quarter of 2024, so investors who started buying bonds (or bond funds) in anticipation of interest rate cuts will be happy with the call they had made.

🇬🇧 UK

UK rate cuts will depend on the fall in inflation and also on the outlook of a possible recession. It is expected that inflation will last for longer in the UK than in the US. The Bank of England may act sooner and cut rates if inflation remains steady at a lower rate and if there is a risk of recession.

The political climate remains uncertain and an election later in the year may keep investors away for most of 2024.

🇯🇵 Japan

After a strong performance in 2023, analysts are not expecting the same for 2024. Modest growth in stock prices is expected, helped a lot by the appreciation of the currency. Many analysts consider the Japanese Yen to be undervalued. Overseas investors could therefore make more on the currency appreciation than in the underlying stocks.

🇪🇺EU

EU markets are poised for good growth in 2024, on a par or even better than the US. There were large cash outflows out of Europe in 2023 which is expected to improve substantially in this year. Lower inflation and lower interest rates bode well for European stocks.

🚢 Shipping update

There have been further attacks on shipping (about 24 in all), posing a risk to the global supply chain. Maersk was planning to return, but has decided to avoid Red Sea routes for now. The choice is to pay a higher insurance premium or take the longer, more costly route around Africa adding 4,000 miles and 10 more days. The cost will be added on to consumers which will be a risk to the prospects for inflation coming down.

Oil tankers do not appear to be targeted.

🛢️ Oil higher : Due to Red Sea tensions, oil markets have ticked up (Brent at $79, WTI at $74 per barrel). Any escalation or expansion could push prices much higher.

💰 Gold's rising : Gold at $2,046 per ounce is volatile, as Red Sea tensions continue.

🌐 Crypto Corner

Bitcoin ETF’s

What is an ETF (Exchange Traded Fund) ? It is an investment fund, traded on an exchange, which buys other financial assets.

The crypto world is buzzing with excitement as approval is awaited for the first Bitcoin spot ETF. There are already Bitcoin futures ETF’s which buys futures contracts on Bitcoin. If approval is given, the Bitcoin spot ETF’s will own actual Bitcoin. This may herald the start of Bitcoin edging from the fringe into the mainstream. Some big financial institutions are hoping to start providing Bitcoin spot ETF’s which may draw in millions of investors and billions of dollars but the volatility and chequered history of crypto currencies may make some investors nervous.

All eyes in the crypto world are on the Securities and Exchange Commission which will give its decision in the coming week.

🏅5️⃣ Billionaire Leaderboard (change in week)

Elon Musk (Tesla, SpaceX)$243bn ⬇️ $8bn

Bernard Arnault and family (LVMH) $187 ⬇️ $14bn

Jeff Bezos (Amazon) $168 ⬇️ $6bn

Larry Ellison (Oracle) $132bn ⬇️$3bn

Mark Zuckerberg (Facebook/Meta) $125bn no change

Next week : Spotlight on residential property

Stay tuned for more insights and updates in a 5 minute round up each week.

If you liked this newsletter, please send this link to friends, family and colleagues https://insight-weekly.beehiiv.com/subscribe